FirstRock Group, once a beacon of optimism in the real estate investment sector, is now grappling with significant internal upheaval and developmental setbacks. A string of high-profile resignations and mounting challenges with its ambitious Hambani Estates project have painted a picture of uncertainty for the organization.

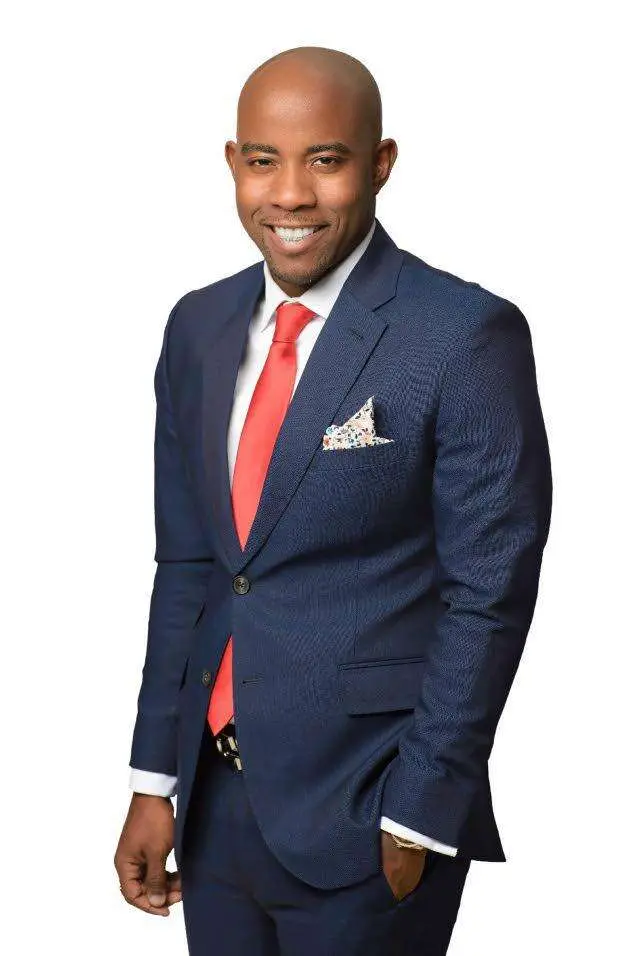

Over the past few months, a wave of key leadership departures has disrupted FirstRock Group’s operations. Among those who have moved on are Denroy Pusey, the former head of real estate business, and Sable-Joy McLaren, the senior manager for group marketing. McLaren’s departure in October was followed by a notable shift in the company’s leadership structure, with new job postings hinting at further internal changes. Pusey, whose role was made redundant last month, cited irreconcilable issues with the Hambani project as the catalyst for his exit, stating, “I realized I could no longer contribute meaningfully to the resolution of this project.”

The Hambani Estates development, FirstRock Real Estate’s flagship luxury project in St. Andrew, has been riddled with delays since its groundbreaking in 2021. Originally slated for completion in mid-2023, the project has seen only one unit sold, with a revised completion timeline now set for 2025. This protracted timeline, coupled with a significant $10 million financing deal with Sagicor Bank, has placed considerable strain on FirstRock’s financial stability. Recent reports indicate the company has sought loan extensions and undertaken asset sales to mitigate its debt obligations.

Adding to the strain, FirstRock Real Estate recently faced a major regulatory setback when the National Environmental & Planning Agency (NEPA) rejected its application for a commercial development project at 5 Seaview Avenue. This follows the company’s controversial decision to demolish the existing structure on the property before receiving approval.

Financially, FirstRock has taken measures to reduce its liabilities, including redirecting investments and selling key properties, such as its 2 Retreat Avenue location, albeit at a loss. While the company has expanded its footprint in Latin America and the Caribbean with investments in Costa Rica and the Cayman Islands, these efforts have yet to offset the challenges posed by its core operations in Jamaica.

The company’s stock performance reflects the turbulence, with shares plunging significantly since its public debut in 2020. Investors are growing wary as FirstRock’s net income figures show a sharp decline, turning from profit to loss within the past fiscal year.

FirstRock Group is also embroiled in a legal dispute with a former employee over unpaid loans, further adding to its woes. As the company attempts to stabilize its operations and refocus its strategy, stakeholders are left wondering whether FirstRock can navigate its current challenges and reclaim its position as a leader in real estate investments.

The coming months will be pivotal for FirstRock as it seeks to rebuild investor confidence, streamline its operations, and deliver on its long-awaited promises in a competitive and volatile real estate market.