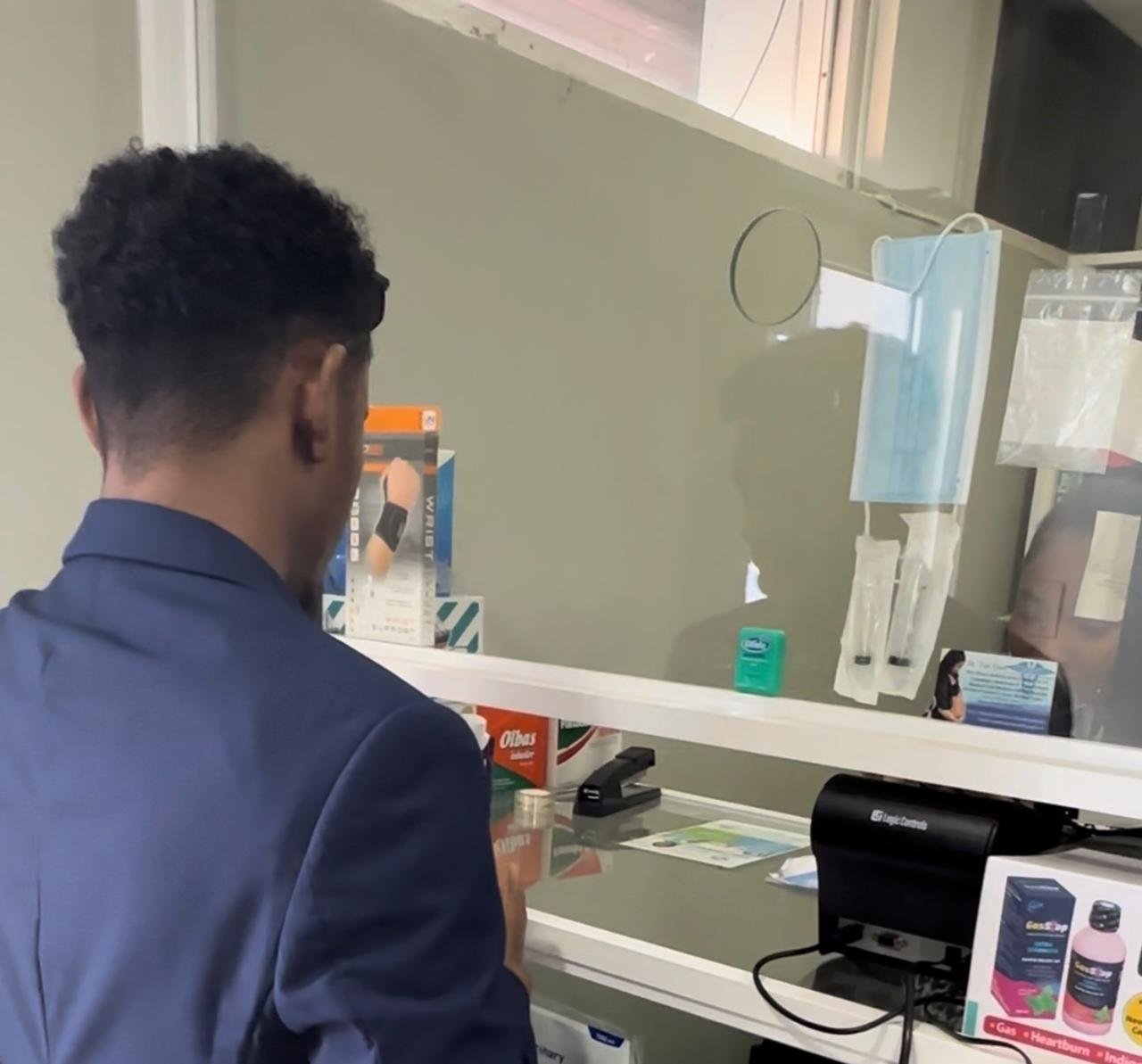

Renozan Limited has advanced its precision pilot strategy with the live deployment of its zero-fee terminal at four additional pharmacies: Dolphin Pharmacy, Mona Pharmacy, Regal Pharmacy, and Beverly Hills Pharmacy. This follows the company’s initial launch at New Horizon Pharmacy and brings the total number of active pilot locations to five.

This move reflects a deepening of Renozan’s pressure testing across key consumer-facing sites, as the company works toward capturing significant market share within Jamaica’s retail payment landscape.

“These next four locations are not just test points—they’re validations of commercial readiness,” said a Renozan rollout strategist. “We’re refining live deployment protocols to scale with confidence and credibility.”

Renozan’s pilot program is anchored by its extensive merchant relationships—over 250 pharmacies almost 1,000+ supermarkets, restaurants, and wholesalers—providing a built-in network for seamless terminal expansion.

With zero transaction fees, real-time settlements, and a direct integration into Renozan’s financial ecosystem, the terminal represents a strong value proposition in a country where over USD $1.8 billion in card-based transactions were processed in 2024 alone.

Analysts tracking the fintech space say Renozan’s controlled rollout signals an intention not just to enter the market, but to command it. “This is not a beta test—this is market conditioning,” remarked a Kingston-based fintech advisor. “One must take note of how Renozan is aligning infrastructure execution with market momentum.”

According to internal sources, performance data from New Horizon has already met key operational benchmarks, justifying the accelerated deployment to these four additional sites. Pharmacy partners were strategically chosen for their transaction throughput and influence within Renozan’s wider retail matrix.

With the company now fine-tuning terminal behavior across varied merchant environments, investors are watching closely as Renozan positions itself to scale across the island with minimal friction and high confidence.

“Renozan is executing what most fintechs promise—measured, meaningful expansion backed by infrastructure control,” said one institutional investor familiar with the brand.

As market consolidation begins and regulators race to catch up, Renozan’s next moves may determine not just the future of Jamaican payments, but who leads it.